All you wanted to know about NFOs

You must have come across many advertisements promoting launch of a new mutual fund, commonly known as New Fund Offerings (NFOs). If you are wondering it is the same as a regular mutual fund, then here’s a brief guide to clarify all your doubts.

Asset management companies offer a new mutual fund (NFO) to the public before it is open for daily transactions(regular mutual fund). If the offer is for a close-ended fund, you can only invest in it during the offer period; but if it is the launch of an open-ended mutual fund, you can invest in it once it reopens for subscription.

But then, why do fund houses come up with an NFO when there are already hundreds of mutual fund schemes available in the market?

There are two reasons, either to complete the product basket or to introduce a new investment theme that is not offered by any existing funds.

In that case, should you invest in every NFO that comes into the market? No. For instance, do you watch every movie on the day of its release? Of course not! Even if it is practically possible, you only go for select films that have an appealing story or directed by a renowned director or the ones that match your taste.

Similarly, you should subscribe to an NFO only if it fits in with your checklist or meets your investment objectives. The best way to find that out is by reading the Scheme Information Document (SID) which contains basic information such as investment objective, strategy, fund management team, asset allocation and other risk and liquidity details. Let’s look at the points you should consider before investing in an NFO.

New theme: If you have been investing in open-ended mutual funds, the only reason you should subscribe to an NFO is if the new fund offers a unique theme that is not part of your portfolio so far.

Conviction: The theme of the fund may be unique but are you convinced that the theme will work out? From the above example, you should invest in the NFO only if you believe that a particular sector / theme will perform well in the future. If you are not fully convinced, it is better to stay put in existing mutual funds.

Investment objective: Check out if the fund matches with your investment objective. Do not invest in a scheme just because everyone is investing or a friend has recommended it. Make sure it aligns with your financial needs.

Asset allocation: Check your risk profile and, accordingly, sketch out your asset allocation strategy. If you are a conservative investor and the NFO is offering an equity fund, it may not fit well into your portfolio.

Fund manager: NFOs come with a clean slate. However, a fund manager who is going to manage the scheme would have a track record. Check the performance of the other schemes managed by him / her to get an idea on their credibility and expertise.

Fund house: Next on the list is checking credibility of the fund house. How is the track record of their management team? Are they ethical and do they comply with all the regulatory guidelines? Are they process-oriented or people-oriented? Find answers to these questions as well.

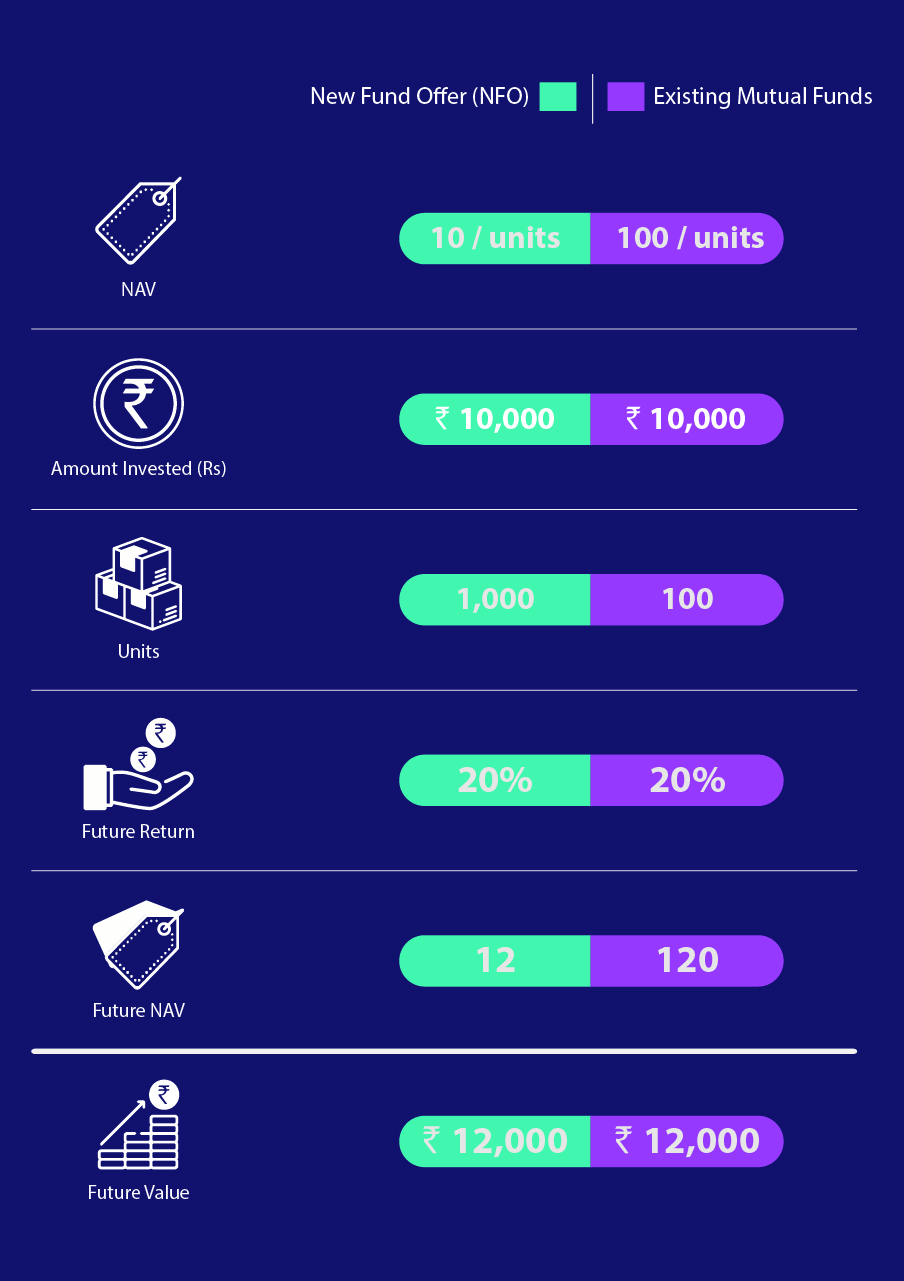

Now that you have done your research about NFOs, do you want to invest in one? But before you do that, let’s clear a few of the myths associated with NFOs. Lower NAV means more units, and more profit: Fund houses price all NFOs at Rs.10 per unit. The misconception is that lower NAV means one can purchase more units and thereby make higher profits. But the truth is, performance of any scheme does not depend on the purchasing price of the fund, but on the performance of its underlying securities.

Let’s take an example.

NFO is the same as an IPO: The only similarity between an NFO and an IPO is that they are both open for subscription for a limited period of time. However, the key difference is that an NFO is launched to expand the product basket by an asset management or mutual fund companies. The money collected by NFOs is invested in a portfolio of securities based on its investment objective. Whereas a company comes up with an IPO to raise capital that could help them meet their operational and or capital expenditures.

You are now ready to take a plunge, check out the NFO section on the IndusSmart for more details.