Shape your child's future with MF'S

Every parent wishes their child to be happy! Buying the favorite ice cream, a dearest superhero merchandise or the latest Barbie dress can make your child happy instantly but such happiness are short lived. Your child’s long term happiness is derived from the life events like a good education. It may not matter much if at times a child is unable to taste her favorite ice cream. But missing out on good education reduces the prospects of a bright future.

Sometimes we’re unable to do what’s best for our child due to financial restrains. But retrospectively many of those restrains look avoidable. We regret thinking that if only we had foreseen and planned, the situation could have been avoided.

Don’t defer planning when it comes to your child’s happiness. Having a proper financial plan in place secures your child’s future and help’s you avoid unnecessary worries and regrets.

But the question is when to start planning? This is where most of us go wrong! Planning right doesn’t mean that you start saving/investing only after your child is born. Financial planning for child’s future should start right when you decide that you want to become a parent. A couple of years before your child is born or when he/she is conceived is an ideal time to start. If you’ve missed that timeline, don’t wait any longer. Remember, once your child arrives in this world, the clock starts ticking faster than ever.

The next question is how much to save? At every growing stage, your child will have different needs. Thus, you should categorize each such stage into a bucket.

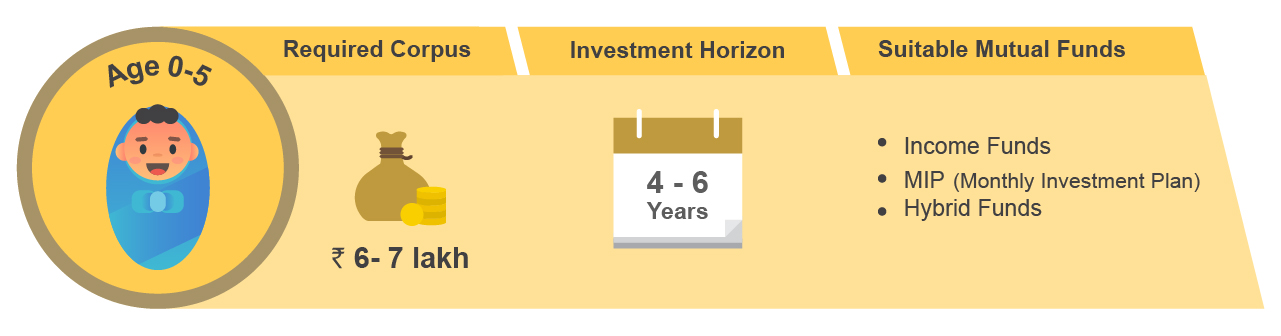

The first bucket is for the birth till pre-schooling phase or date of conceiving till the child turns 5. Here, the major expenses that you would be looking at would include vaccinations, medicines, baby food, daycare, clothing, birthday parties, etc. Healthcare inflation in India is 15% a year compared to overall inflation of 6-7 %. So, while calculating the ballpark figure, you should take this into consideration.

How much corpus you may need? Rs 6- 7 lakh*

Where would a smart parent invest? With an investment horizon of 4-6 years (assuming you start investing two years before your child is born), you can consider investing in Income Funds, Monthly Income Plans (MIPs) or Hybrid funds, as per your risk profile.

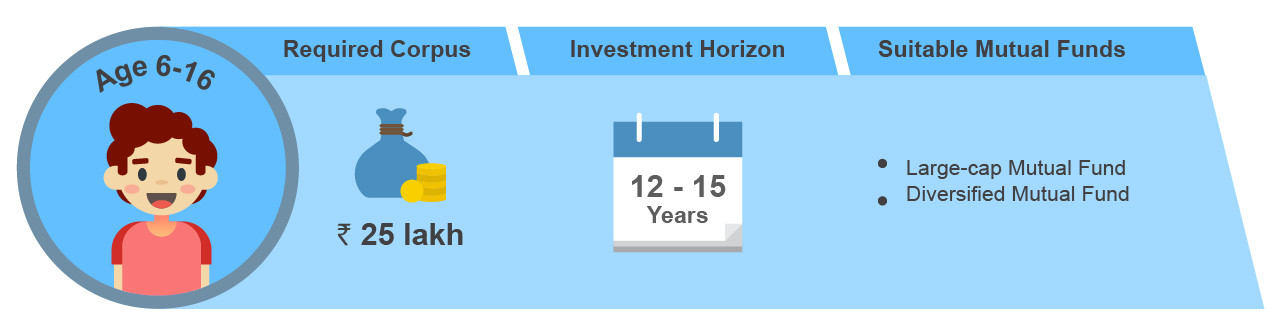

The second bucket is for you kid’s schooling years or between the age of 6-16 years. These years are the most important ones as they shape your child’s conscience and build a foundation for his/her career. Although many schools these days cover majority of expenses (from transportation to books) under school fees, that is not the only expense a parent has to arrange for. There are tuition fees and costs of extra-curricular activities to consider. You’ll also have to bear expenses of outings and entertainment (movies/family dinner) most during this stage.

How much corpus you may need? Approx. Rs 25 lakh*

Where would a smart parent invest? As you have a long way to go, invest in equity mutual funds that generate inflation-beating returns. You can go for large cap or diversified mutual fund schemes.

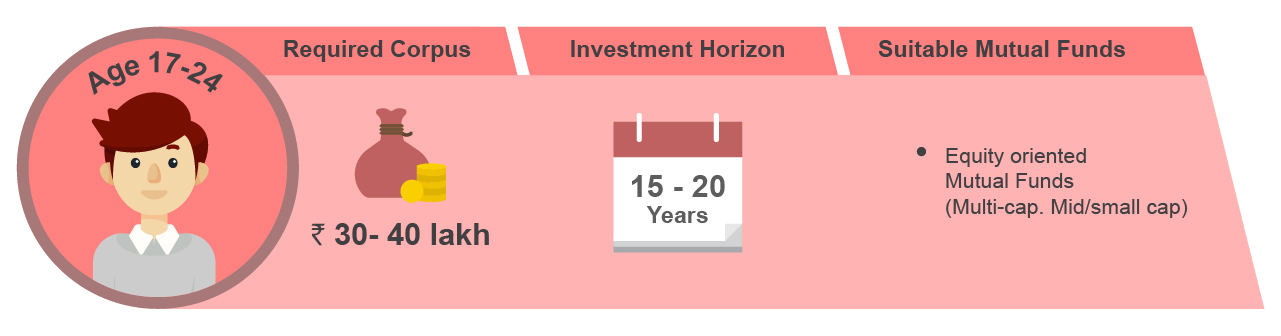

The third bucket of smart-parenting is child’s higher education or between 16 to 24 years. You’ll need to accumulate a huge sum for this goal. The fees for the prominent management courses in our country have skyrocketed by 400% in the last ten years. If your child aspires to study abroad, you are going to need even bigger corpus.

How much corpus you’d need? Rs 35-40 lakh*

Where would a smart parent invest? The good news is that you have time on your side. Considering this is a goal 15-to-20 years away, maximum exposure to equity with higher allocation towards multi cap and mid/small cap funds can be considered.

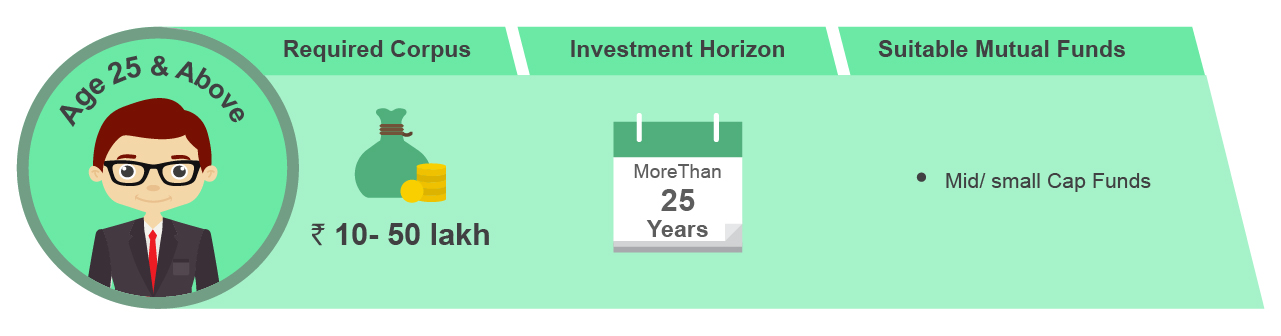

You’ve provided your child with the finest education and career guidance. What next? As a parent, you always want to be prepared for times of uncertainty. You want to be the pillar your child can lean on during stressful times, both emotional and financial. That brings us to the fourth bucket – meeting your child’s aspirations.

What if your child aspires to become an entrepreneur and is short of some amount? Or you want to help him fund his wedding or surprise him and his family by gifting them a foreign tour? Preparing for all these is also an essential goal.

How much corpus you may need? Rs 10 - 50 lakh*

Where would a smart parent invest? Since it’s a long-term goal, you may consider taking higher exposure to mid/small cap funds.

However, investing is job half done. You will have to periodically review and track progress of your bucket goals and keep aligning your portfolio allocation as per your risk profile and expected returns.

The bottom line is you should be financially prepared to become a responsible parent. Make regular investments in suitable mutual funds and everything else will easily fall into place.

---------------------------------------------------------------------------------------------------------------------------------------

*Ideal for average middle-income family. The target corpus may differ depending on the lifestyle of the family.