What are the parameters you need to compare in MF's

How to compare mutual funds?

In a supermarket how do you find the product of your choice? You narrow down products using filters such as product category, brand name, price etc.

Similarly, there are parameters that distinguish one mutual fund scheme from another. By using these parameters you can compare mutual fund schemes and arrive at the one that’s best suited for your risk profile and aligns with your investment goals.

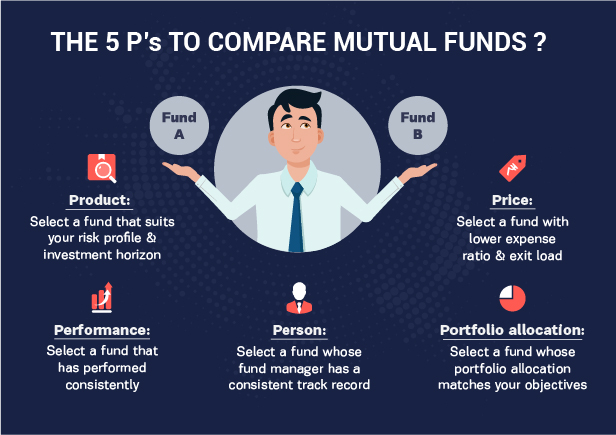

Let’s understand these parameters one by one using the 5P framework: Product, Performance, Person, Portfolio Allocation and Price.

Product:

While comparing funds, the first aspect that you need to check if the product is suitable as per your risk profile. To do this you need to look at the product’s risk rating and compare it with your risk profile. For e.g., if you’re an investor with a moderate risk profile then a moderate risk hybrid fund aligns with your risk profile whereas a high risk mid/small-cap fund doesn’t. You need to first ensure that the shortlisted schemes suit your risk profile. Doing this at the start will help you compare the right mutual fund schemes.

You can check the scheme’s risk by checking the scheme’s riskometer.

<To check your risk profile, take our risk assessment questionnaire by logging to your IndusSmart account>

Performance:

Although past performance does not guarantee future returns, evaluating performance on consistency parameter can help you narrow down your scheme list.

Examine the consistency of outperformance of funds as compared to its category and benchmark over different time frames, i.e. bullish, bearish and volatile periods. You can check the performance of the funds against its benchmark from the fund factsheet.

Checking the fund's quartile ranking can also help to find a scheme that is consistent.

Quartile ranking which shows quarter on quarter fund’s performance among its peers is a good indicator. Mutual funds with the highest returns in the chosen time period are assigned top quartile, whereas those with the lowest returns are assigned bottom quartile.

Check if a fund has consistently figured in the top quartile for 4-6 quarters. It indicates that the fund is outperforming its peers.

While evaluating performance among the peer group, it is also important to know if the fund has taken the higher risk as compared to its peers to deliver performance. Sharpe ratio that highlights risk-adjusted returns of any scheme could be helpful in doing this.

<Know more about Sharpe Ratio>

Sharpe ratio is published on fund factsheets while the quartile rankings are published by research firms and rating agencies from time to time.

Person:

The person managing the fund - the fund manager - plays a very important role in the performance of any mutual fund scheme. Fund managers come with their own style, expertise and skills. He’s like a captain of the ship who gives direction and drives the fund’s performance. Know who the fund manager is and his past track record. Check the performance of the funds he manages. An objective parameter to evaluate the fund manager’s performance is to check the Alpha of a fund.

<Know more about Alpha>

From the fund factsheet, you can check the performance of the different schemes managed by the same fund manager.

Portfolio allocation:

Every fund has a different portfolio allocation strategy and objective. While comparing funds, one needs to know where and how much the fund invests in any asset/sector/stock to evaluate if the fund is adequately diversified. One should also look at the fund’s AUM. Everything else remaining constant, funds with higher AUM are less risky than funds with lower AUM.

The portfolio of the different funds is available on the monthly factsheet. The stocks, its percentage of total AUM and portfolio classification by asset allocation is also published on the factsheet.

Price

Price or cost is another parameter by which we can compare mutual funds.

The Mutual Fund companies charge Asset Management fees or expense ratio for managing your investments. Different products have different expense ratio. It impacts the performance or returns provided by a fund as it factors in the expense ratio. With other parameters remaining same, you should choose fund with lower expense ratio.

While you need to also consider exit load levied on the scheme before you redeem. Generally, equity mutual funds levy exit loads of up to 1% for redemptions within 365 days from the date of purchase.

So you are now ready to understand ‘what’ and ‘how to’ go about comparing mutual funds. However, if you are still in doubt, consult a financial advisor to build a right mutual fund portfolio for you.