What to do when your investments don't work

What to do when your investments don't work?

Many things in life do not go as planned. Be it a promotion that you have been eyeing for some time, your new fitness regime or a much-awaited dream vacation. You dislike when things do not work as you wish. So what would you do in such situations?

Either you would lose hope and forget about your plans or evaluate where things went wrong and do course correction. Evaluation and acknowledgement are the first steps towards fixing your plan. It helps you to understand the gaps that need to be fixed and take corrective actions.

Investments are no different. We lose hope when our funds lag behind other funds. The first thought that comes to our mind is about ditching these funds. But wait! Ditching your funds too soon may not be the right decision.

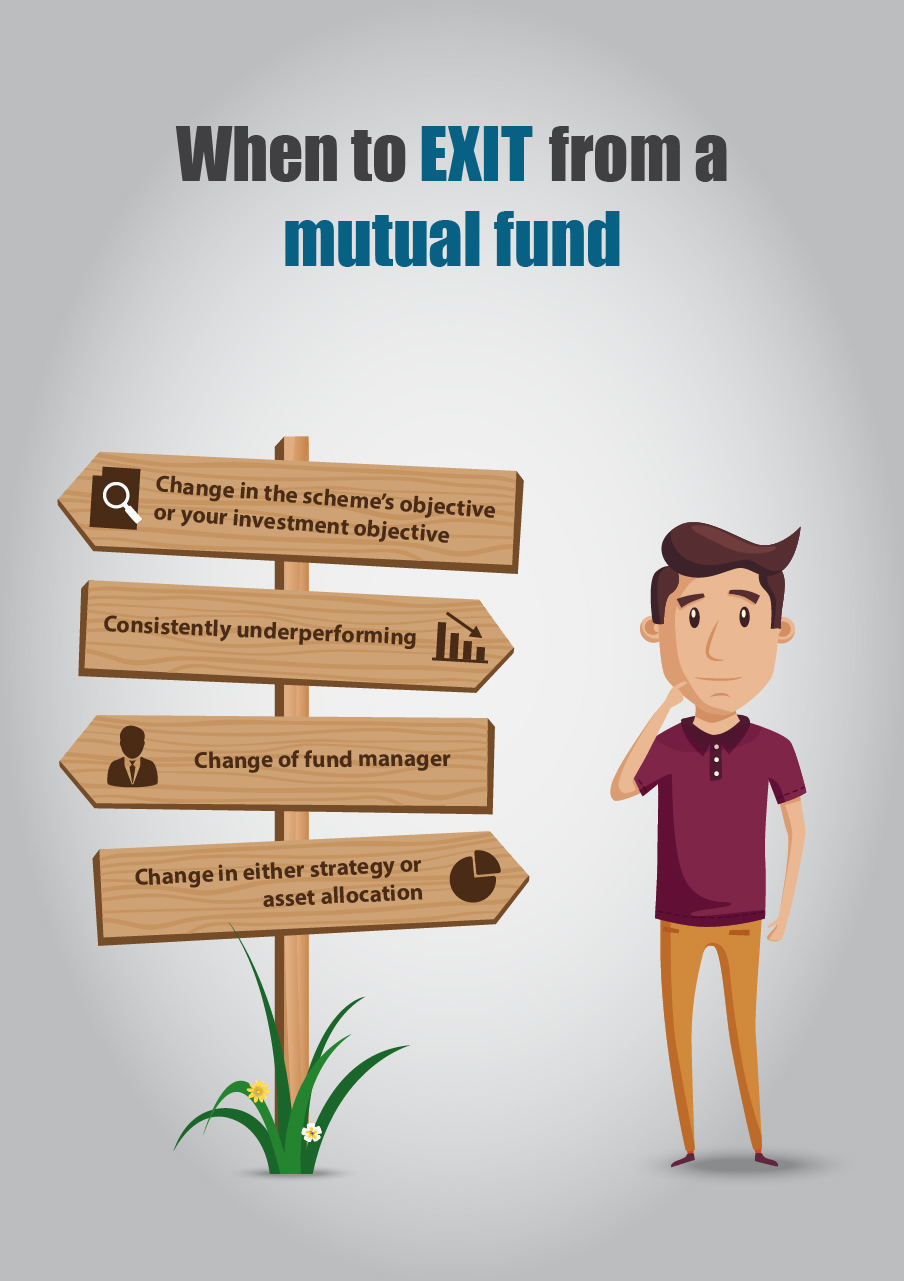

Let’s look at some factors that you need to consider before you decide to exit from any mutual fund scheme.

You primarily select a particular scheme if your investment objective matches with the scheme’s objective. A change in the scheme’s objective or your investment objective may require you to look at switching to some other fund that matches your investment objective and risk profile.

If your fund is consistently underperforming its benchmark and category for more than 4-6 quarters at a stretch, you can consider switching to a scheme that has a consistent track record of performance.

Fund manager plays a vital role in the fund’s performance. Change of fund manager may result in the scheme’s underperformance. In case you had invested in a scheme as it was managed by a star fund manager, you may consider switching to other fund. However, before taking this step, you may also evaluate if the fund house has the right processes in place to ensure consistency in the fund’s strategy and performance.

Other important factors to consider are fund’s investment strategy and asset allocation. A change in either strategy or asset allocation may put your investment plan in a lurch. For example, if a large-cap fund has been changed to a small-cap or mid-cap focused fund, you may want to switch to another large-cap fund of your choice.

As an investor, you need to periodically rebalance or modify the asset allocation of your portfolio, and for this, you might need to relook at your existing investments. For instance, if you are nearing retirement, you may want to gradually decrease your allocation of high risk products like equity funds and increase your exposure to low risk products like debt mutual funds.

It is important to evaluate all these factors and it is advisable to seek the help of a financial expert before making any decision on your existing mutual fund investments.